tax avoidance vs tax evasion uk

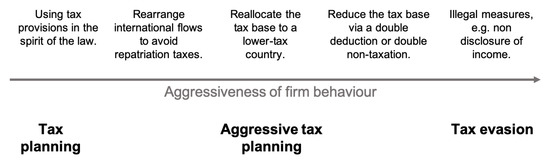

Such tax avoidance is thought by some to be unacceptable as flouting the spirit of the law while following the letter albeit not criminal in the way that evasion is. Tax avoidance may exist in a controversial area of the tax system but tax evasion most definitely doesnt.

Tax Evasion Vs Tax Avoidance Know The Difference Ico Services

This could include not reporting all of your income not filing a tax return hiding taxable assets from HMRC or using fake offshore accounts.

. It always creates a lot of anger and questions about how to get away with it even when the news is known. Evasion and avoidance in th. It is the illegal practice of not paying taxes not reporting income reporting illegitimate expenses or not making payment for taxes owed.

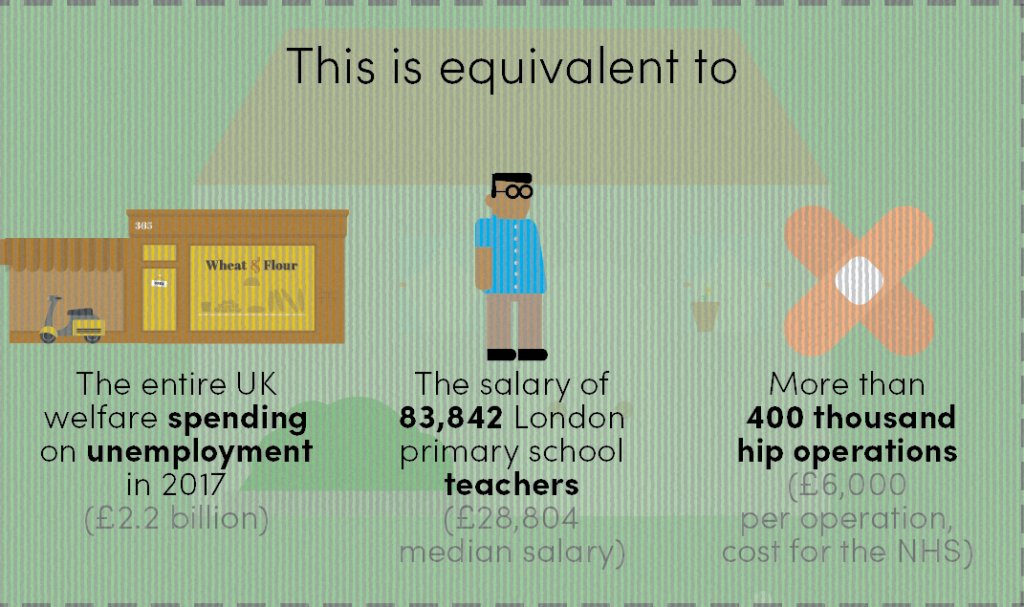

Tax evasion and tax avoidance costs the government 34 billion a year. Of this 15bn An estimated 7 billion a year due to Evasion where individual or corporate taxpayers have deliberately omitted concealed or misrepresented information in order to reduce tax liabilities. Another difference between these terms is the fact that tax evasion is a criminal offence under the provisions of the Federal Inland Revenue Services Act while Tax Avoidance is not a criminal offence.

This is wrong according to the estimates its using. Well one massive difference is that tax evasion is illegal while tax avoidance is legal well to a certain extent anyway. Tax evasion is when you use illegal practices to avoid paying tax.

So above I started off talking about Tax Evasion vs Tax Avoidance. According to most recent official estimates tax avoidance in the UK costs the Exchequer about 18bn a year while tax evasion is believed to cost an eye-watering 53bn. Lord Templemans article in a 2001 Law Quarterly Review called Tax and the Taxpayer identified 3 approaches used to reduce tax burdens.

The most common example of Tax Evasion amongst small. However in some sophisticated cases the Taxman has been trying to blur the boundaries and claim some forms of tax avoidance are illegal. An estimated 5billion a year due to criminal attacks on the tax system involving coordinated and systematic attacks by.

HMRC estimates that 27 billion was lost through tax avoidance and 44 billion through tax evasion in 201314. The difference between tax planning and tax avoidance is that tax avoidance always increases your tax risk. Businesses get into trouble with the IRS when they intentionally evade taxes.

It is estimated that in 201920 the financial loss from tax avoidance was 15 billion while the cost of tax evasion was 55 billion. Tax evasion and tax avoidance can be easily be confused - here are the differences and the implications if you avoid paying tax Maryse Godden 1337 8 Nov 2017. Tax Avoidance Disclosure In March 2011 the Revenue issued a document entitled Tackling Tax Avoidance which detailed how they would be approaching the problem of tax avoidance.

Tax evasion is ILLEGAL. Avoiding Value Added-Tax VAT. In September 2021 HMRC published revised estimates which put the tax gap at 35 billion for 201920 representing 53 of total tax liabilities.

The terms tax avoidance and tax evasion are often used interchangeably but they are very different concepts. Tax avoidance involves bending the rules of the tax system to try to gain a tax advantage that Parliament never intended. See below for the various types of tax evasions in the UK.

But some businesses and individuals go much further to minimise their tax liabilities which can give rise to accusations of tax avoidance if not blatant tax evasion. Some practices of tax avoidance have been found to have the. One is illegal the other legal though arguably immoral on a larger scale.

It often involves contrived artificial. Putting your savings into an ISA for example is one of the more commonplace methods people use to. We look at the difference between legally avoiding tax and illegally evading it.

34 billion is the total value of tax that goes uncollected. Some luminaries have 3 categories instead of 2. Tax Evasion vs Tax Avoidance.

On the other hand examples of tax avoidance include claiming capital allowances on things used for business purposes to pay tax at a lower rate. But your business can avoid paying taxes and your tax preparer can help you do that. Tax planning either reduces it or does not increase your tax risk.

If you do decide to listen you need to be very wary because TAX AVOIDANCE is legal but TAX EVASION is not. Its as simple as that. In recent years concerns as to the scale of mass marketed tax.

The perpetrator can be convicted for six months in jail fined up to 5000. Not all measures to avoid paying tax are illegal. The most commonly used definition is that tax avoidance is legal while evasion is not.

In very simple terms tax avoidance is legal but tax evasion is illegal and you risk prosecution for breaking the law. Because there is a difference between tax evasion and tax evasion. They state that more than a sixth of that amount is due to tax evasion but a further one sixth is due to tax avoidance the balance being just uncollected taxes.

Magistrates court cases can sentence up to six months in jail. It is sometimes difficult to appreciate the difference between the two but in basic terms tax evasion is deliberately escaping from paying tax that should be paid whereas tax avoidance is the exploitation of rules in order to reduce the. It even makes big news for celebrities and large multinationals.

The UK authorities use the term tax mitigation to refer to acceptable tax planning minimising tax liabilities in ways expressly endorsed by Parliament. What tax avoidance is. In addition Annex A lists details of over 100 measures the government has introduced since 2010 to crack down on avoidance evasion and non-compliance and Annex B consists of two reports one.

Basically tax avoidance is legal while tax evasion is not. This is a criminal offence and not only can you end up in prison you could also be named and shamed by HMRC if youve avoided. Tax avoidance is structuring your affairs so that you pay the least amount of tax due.

The first method is tax evasion and is a criminal offence. In its most simplistic form there are plenty of people whose financial actions may be labelled as tax avoidance. Unlike tax avoidance tax planning is the practice of minimising tax liability with no intention of deceit.

The maximum penalty for evading income tax is seven years of prison time or an unlimited fine. The difference between tax evasion and tax avoidance largely boils down to two elements. Tax avoidance has always created interesting news.

Furthermore it is an illegal offence.

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Tax Evasion Vs Tax Avoidance Ppt Powerpoint Presentation Gallery Professional Cpb Powerpoint Templates

Tax Avoidance Vs Tax Evasion What S The Difference

How Much Does Tax Avoidance Cost

James Melville On Twitter We Lose 120 Billion In Tax Avoidance And Tax Evasion That S Enough To Give The Nhs 2 Billion A Week Put That On The Side Of A Bus

It Is Important To Understand That Tax Planning Tax Structuring And Tax Avoidance Are All Perfectly Legal Tax Evasion Is Not Tax Haven Investing Books Books

Tax Avoidance Is Not Tax Evasion But Try Telling Politicians Private Banking Asset Protection And Financial Freedom

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Tax Avoidance Or Tax Evasion Neither Go For Good Tax Planning Accounting Humor Fun At Work Have A Laugh

Tax Evasion Vs Tax Avoidance What S The Difference Youtube

The Fraud Triangle Applied To Tax Avoidance Download Scientific Diagram

Pdf Tax Evasion Tax Avoidance And Tax Expenditures In Developing Countries A Review Of The Literature Semantic Scholar

Revk S Ramblings Tax Avoidance

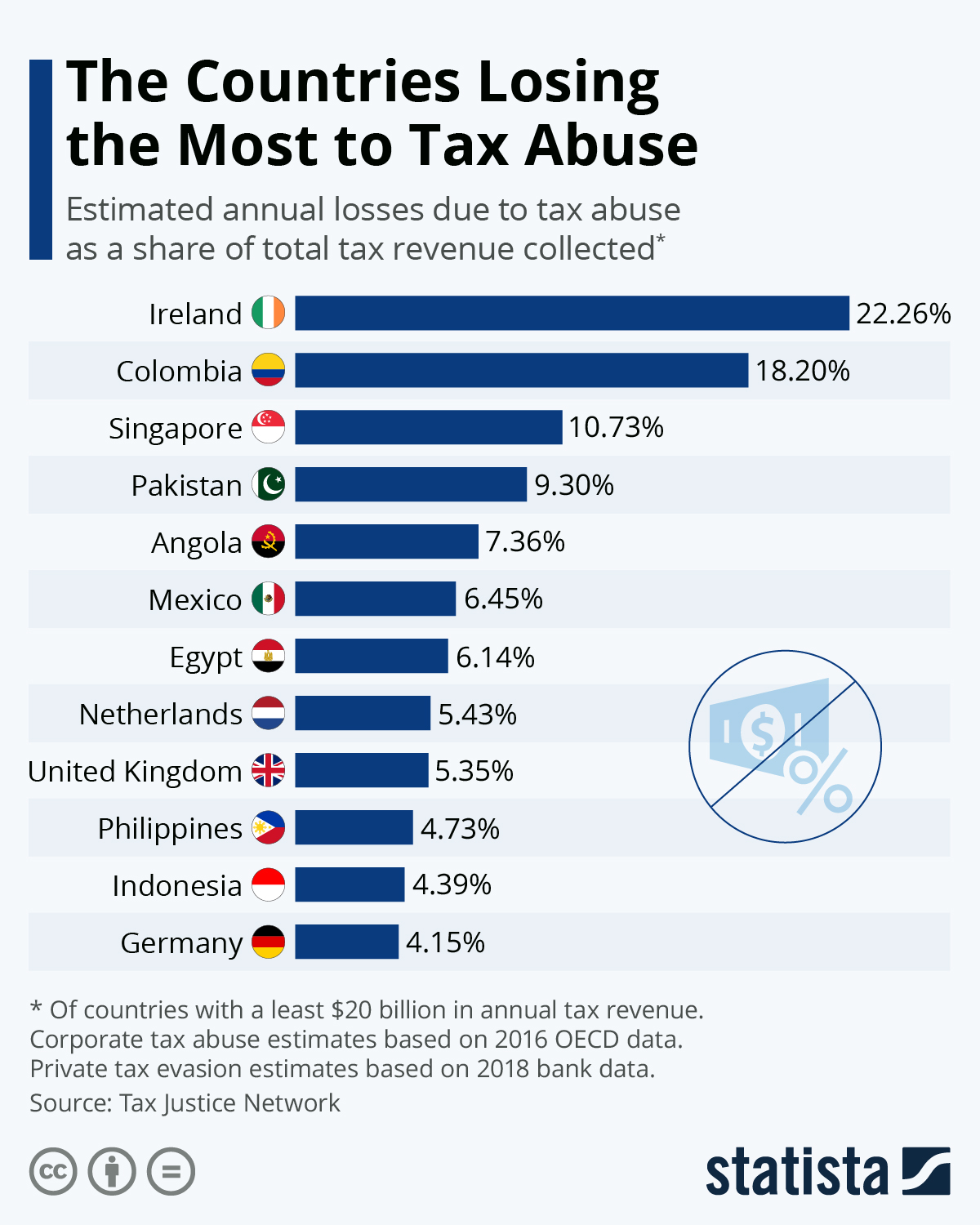

Uk Second Best At Tax Avoidance

Games Free Full Text Gaming The System An Investigation Of Small Business Owners Attitudes To Tax Avoidance Tax Planning And Tax Evasion Html

The Human Cost Of Tax Avoidance By The Superrich And Multinationals New Global Report Epsu